My Role & Skills

About

Interaction Designer

User Journey Mapping, Stakeholder Management, Wireframing, Visual Design

Duration

2 months, May - July 2020

The team

My role in this project ranged from client interactions to mapping the business processes and designing the final screens. An escrow is a contractual arrangement in which a third party receives and disburses money or property for the primary transacting parties, with the disbursement dependent on conditions agreed to by the transacting parties. This project was centered around creating an online platform for an escrow services company.

The Core Aims Were: 1. Allowing clients to start transactions and invite relevant parties to the platform; 2. Facilitating regular updates about the transaction status to all parties; 3. Simplifying the company team's process of updating payment information.

Design Lead, Mentor

Visual Designer

Business analyst

Myself - Interaction Designer

The Steps

Users & Process

How does the escrow process work? Who is involved?

The Buyer

One of the 2 main people in any escrow transaction, the one who initiates the payment activities. They want their money to be secure until their exchange has been completed.

Trust | Visibility | Security | Sense of Control

The Other Disbursements

Agents, Commissions or other smaller amounts that may be part of the transaction from either of the main players. They cannot control the transaction, but need to know where it stands.

Visibility

The Seller

The one who receives the escrow amount. They must fulfill the terms agreed upon for the money to be transferred from the escrow account.

Trust | Visibility | Security | Redressal

The Admin

From the business who facilitate escrow transactions. They have to ensure transactions are successful, hiccups are addressed and all parties retain trust and security.

Control / Visibility / Power

Escrow processes can be complex. Agreements may change, amounts may need modification and the whole deal could fall through for any reason. Verification is a vital part - for people as well as transaction steps. Money tends to trigger anxiety, so a process that offers flexibility and the chance to cancel within reason had to be set in place. The variations in the system for each party also had to be captured in detail - confidentiality is key.

Drafting

Invite parties

Payments

Trade Completion

A system

The final product was split into 3 parts

THE FRONT FACING WEBSITE

Escrow services for transactions other than property could be a new concept to many. The landing page had to be educational for visitors to understand how the escrow process works, aiming to register this information in their memory and convert them into users.

Jobs to Be Done (JTBDs) - Buyers & Sellers

Hiring a Trusted Escrow Service

01

When I am looking for a secure way to facilitate transactions between my business and clients, I want to find a trusted escrow service online so that I can ensure the safety of financial transactions and build trust with my partners.

Accessing Customer Support

04

When I encounter issues or have questions about the escrow services, I want easy access to customer support through live chat, FAQs, or contact forms, so that I can quickly get the assistance I need.

Exploring Escrow Solutions

02

When I need to explore different escrow solutions for my B2B transactions, I want a website that provides clear information about features, pricing, and benefits, so that I can make an informed decision that aligns with my business needs.

Getting Started with Escrow Services

05

When I've decided to use escrow services for my business, I want a website that guides me through the onboarding process with clear instructions and user-friendly interfaces, so that I can quickly start using the service.

Understanding the Escrow Process

03

When I'm new to using escrow services, I want a website that explains the escrow process in simple terms, so that I can understand how it works and feel confident about incorporating it into my business transactions.

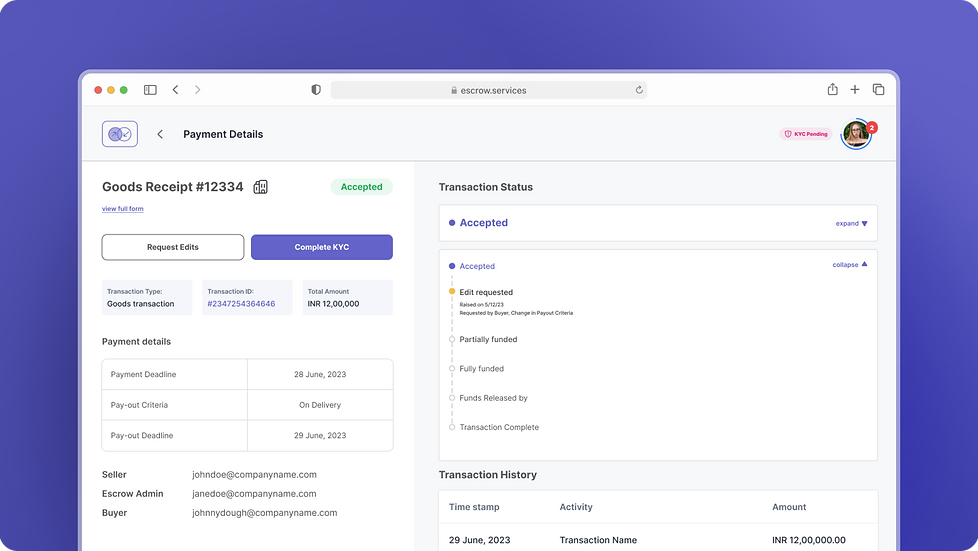

THE USER DASHBOARD

The central product focuses on how Buyers, Sellers and their related parties would experience the transactions. One of the key challenges was ensuring that the balance of power did not shift too far towards either party, which would risk them distrusting or quitting the platform. Making sure that each party found the flow intuitive, while maintaining trust in the product was essential.

Jobs to Be Done (JTBDs) - Buyer

Ensuring Secure Transactions

01

When I'm purchasing goods or services from a new supplier, I want to use an escrow service to ensure that my payment is secure until I receive and verify the quality of the products, so that I can confidently engage in transactions with unfamiliar sellers.

Minimizing Financial Risks

02

When I'm buying high-value items or conducting transactions with unknown sellers, I want to use an escrow service to minimize the financial risks associated with online purchases, so that I can protect my investment and avoid potential fraud.

Streamlining Payment and Delivery

03

When I'm making a purchase through an online marketplace, I want to use an escrow service that facilitates a streamlined payment and delivery process, so that I can receive my order efficiently and without complications.

Jobs to Be Done (JTBDs) - Seller

Building Credibility with Buyers

01

When I'm selling to new customers or clients, I want to use an escrow service to build credibility by demonstrating my commitment to fair and secure transactions, so that I can establish trust and encourage repeat business.

Expedited Payment Release

02

When I've fulfilled the terms of the agreement and delivered the products or services, I want to use an escrow service that expedites the release of funds, so that I can access my earnings promptly and efficiently.

Accessing Transaction Records

03

When I need to review past transactions or provide proof of delivery, I want an escrow service that offers easy access to transaction records, so that I can maintain organized records for my business and address any potential disputes.

THE ADMIN DASHBOARD

The Escrow service admin also had several requirements. They had to handle a full overview of transactions, users and queries, which could potentially be very high volume.

Jobs to Be Done (JTBDs) - Escrow Admin

Ensuring Regulatory Compliance through KYC Verification

01

When I'm tasked with verifying user identities to ensure compliance with Know Your Customer (KYC) regulations, I want tools and processes in place that streamline the KYC verification process, so that I can efficiently and accurately validate user information.

Facilitating Fund Release from Escrow

04

When transactions are successfully completed, I want a system that allows me to trigger the secure release of funds from the escrow account, so that I can ensure timely and accurate disbursement according to the terms of the agreement.

Monitoring and Managing High-Volume Transactions

02

When I need to oversee a large number of transactions, I want a comprehensive dashboard that provides a real-time overview of all transactions, so that I can quickly identify and address any issues or discrepancies between parties.

Providing Effective Query Resolution

05

When users have queries or concerns, I want access to a robust system that organizes and prioritizes user queries, allowing me to provide quick and effective responses, so that I can maintain a high level of user satisfaction and trust.

Proactively Following Up on Stalled Transactions

03

When transactions reach a point of inactivity or one party has fallen off, I want automated alerts and follow-up mechanisms that enable me to proactively address and revive stalled transactions, so that I can maintain the integrity and completion of each transaction

Scaling Operations Efficiently

06

When the volume of transactions and user queries increases, I want efficient tools and processes that enable me to handle the growing workload without compromising on the quality of service, so that I can ensure smooth and responsive operations.

Wireframes

This project spent a significant amount of time at the wireframing stage. There were questions around how each step of the process would work, how different users would see the same screen, and the trigger points for changes in the status flow.

A closer look

Hi-Fidelity Designs - A little story

The Buyer

John is initiating a high value transaction for a batch of goods. He wants to ensure that the seller receives their payment only when the goods have been delivered and checked.

The Seller

Amelia is preparing to ship the goods for this transaction. She wants to ensure that the terms are clear and well-documented. She also needs to ensure that the buyer has the required funds before starting the shipment.

01

Initiating a Transaction

John creates an account and begins to initiate the escrow process.

02

Drafting the Transaction

John begins filling in the agreed upon details, tagging the relevant people - this includes the seller and his own other disbursement. The seller can add their own disbursements upon receiving the transaction details. John can save details and come back later, or discard all of it at this stage. When he is done, he creates the transaction and the transaction request is sent to Amelia, the seller.

03

Now, Some waiting

John fills in all the details, clicks on 'CREATE' and send the transaction details off to Amelia. Now, he waits for her to accept, or request changes. He can create other transactions, and also sees any requests he receives here.

04

Transaction Accepted

Once Amelia has reviewed and approved the transaction, next steps begin. If changes are required, now is the time to bring it up. Both parties complete their KYC if it is their first transaction, then John sees the Escrow account details to transfer money. Transfer can be partial or all at once, leading up to the decided deadline. The left panel changes to accommodate the stage of the process.

Status changes are mapped to user actions, and stages of the transaction. Semantic coloring is used only for the most vital steps.

Status Flow

05

And the show goes on

The transaction progresses through different statuses, culminating with the funds being released. Transaction history is recorded throughout. When John is satisfied with the goods, he can release the funds to Amelia. Alternatively, Amelia can produce proof of completion and trigger a timed payout. Admin holds final authority over stopping or releasing payments.

The Details

Error messaging

Any product with this many forms and details requires a little extra attention to how errors are addressed. Especially because money is involved, this was an exciting chance to brush up UX writing skills and polish out the details.

Responsive Design

Ensuring that the dashboard works across all devices was a given. But, information and priorities had to be carefully considered when presenting on smaller screens. This gave users the freedom to check their transaction status on the go.

Mobile screens

Tablet Screens

Desktop screens

Wrapping Up

While this project was sunset a while ago, I have carried the learnings into my full time role at SAP Labs, where I continue to simplify status flows, design for various roles and build complex dashboards.

© 2023 Malavika Vijayan. All Rights Reserved.

Made with love, Figma and many Vanilla Lattes

Write to me on @v.malavika297@gmail.com if something caught your eye. Always open to chat!